Baseline Market Making

Under the hood, the BLV is a feature of a much larger system. Baseline Protocol is a fully automated, on-chain market-making system that provides sustainable and efficient liquidity for tokens. Unlike traditional market-making models that rely on external participants to provide liquidity, Baseline is designed to own and manage liquidity autonomously, ensuring continuous price discovery and minimizing extractive value flows. Each time a bToken is traded or borrowed, Baseline accrues a small liquidity surplus via swap fees or interest, permanently growing the BLV.

Baseline's liquidity rebalances are unique in that they are handled by the protocol and executed permissionlessly: There's no centralized market maker in charge of liquidity provisioning, the protocol executes market making operations itself through smart contracts.

The key difference between Baseline and traditional market-making strategies is that Baseline aims to maximize value for

its token holders. In the latest iteration, Baseline introduces Leveraged Anchor LP, an advanced liquidity strategy that enhances capital efficiency, while maintaining deep liquidity at key price levels. At the core of this system is the rebalance() function, which dynamically adjusts liquidity allocation based on market conditions.

If you’re interested in how Baseline has evolved from previous versions, you can explore older versions here.

Intelligent Liquidity

Today, most on-chain liquidity is passively deployed as a single static liquidity position. This liquidity is often extremely inefficient and naively priced, requiring significant external capital to be effective. Most importantly, the structure does not allow for any flexibility, preventing the liquidity from adapting to changing market conditions.

At its core, Baseline eliminates the inefficiencies of traditional liquidity provisioning by directly controlling liquidity through smart contracts. This ensures that tokens remain liquid without relying on external market makers who might act in self-interest.

Instead of the four previous liquidity operations, Baseline V3 consolidates and streamlines all market-making functions into a single rebalance() mechanism. This increases efficiency and allows the protocol to continuously manage liquidity, adjust price support levels, and optimize capital deployment without manual intervention.

The Rebalancing Function

The rebalance() function is the core operation that adjusts the protocol’s liquidity positions in response to market changes. Rather than using multiple distinct liquidity operations, rebalance() handles everything automatically, ensuring efficient liquidity management. This function dynamically repositions liquidity to strengthen market depth and support price, making trading smoother and more sustainable.

Leveraged Anchor LP: Optimizing Liquidity Deployment

To improve capital efficiency on conditions like huge sell offs, Baseline introduces Leveraged Anchor LP, a liquidity management strategy that ensures deep liquidity in the anchor position to support sell-offs while maintaining overall price stability. This method applies Baseline’s underlying borrow mechanic to increase the liquidity of the anchor position, using the borrowed reserves of the tokens it will buy back with that range. Whereas looping is enabled by buying tokens first and then borrowing the reserves after, leveraged LP is the inverse: borrowing the reserves first and buying the tokens after.

Understanding Liquidity Reserves

Baseline classifies the total reserves (non-token liquidity owned by the protocol) into two key components:

- Backing: The reserves required to buy back the entire circulating supply at the current Baseline Value (BLV)

- Buffer: The surplus reserves beyond the backing requirement, which can be leveraged for liquidity operations

The buffer is the portion of reserves that the system can apply leverage to, allowing it to enhance liquidity depth without increasing external capital requirements.

Leverage in the Anchor Position

The amount of leverage that can be applied to the buffer liquidity is impacted by the position of the anchor, and can be calculated by using Anchor Capacity Units (ACU). ACU represents the number of tokens that can be bought per unit of reserve in the current anchor range.

Example: If $1 could buy back 40 tokens in the current anchor structure, then the ACU is 40

Baseline then calculates the BLV of the ACU, which is the floor value of the position, or the amount of the position that can be borrowed from the floor. Baseline then subtracts this value by 1 to find the bufferLiquidity of the position, or the amount of buffer spent per ACU deployed in the position. Finally, the system divides 1 / bufferLiquidity to find the leverage of the current position, as this is the ratio of total reserves / buffer reserves used.

Another key component in the anchor liquidity calculation is the utilizationRate. Rather than max leveraging all the available bufferReserves, the market making strategy only deploys a % of the buffer based on the current premium. The higher the premium, the more conservative strategy—with a minimum utilization set to 50%.

Put simply, the system calculates how much leverage can be applied based on the buffer reserves available, the premium, and the liquidity needs at different price levels.

By borrowing reserves before buying tokens, the protocol ensures that it can provide liquidity efficiently while maintaining a robust market structure.

Automatic BLV Bumping

Baseline’s liquidity model ensures that tokens maintain a Baseline Value (BLV), which represents the guaranteed minimum price at which liquidity is available.

The rebalance() function automatically raises the BLV when two conditions are met:

- The token price exceeds a certain premium threshold (

BUMPABLE_PREMIUM). - The protocol has sufficient reserves (including leveraged reserves) to buy back the entire circulating supply at a higher price.

This ensures that BLV increases are sustainable and fully backed, preventing artificial price floors that could collapse under stress.

Dynamic Anchor & Discovery Liquidity

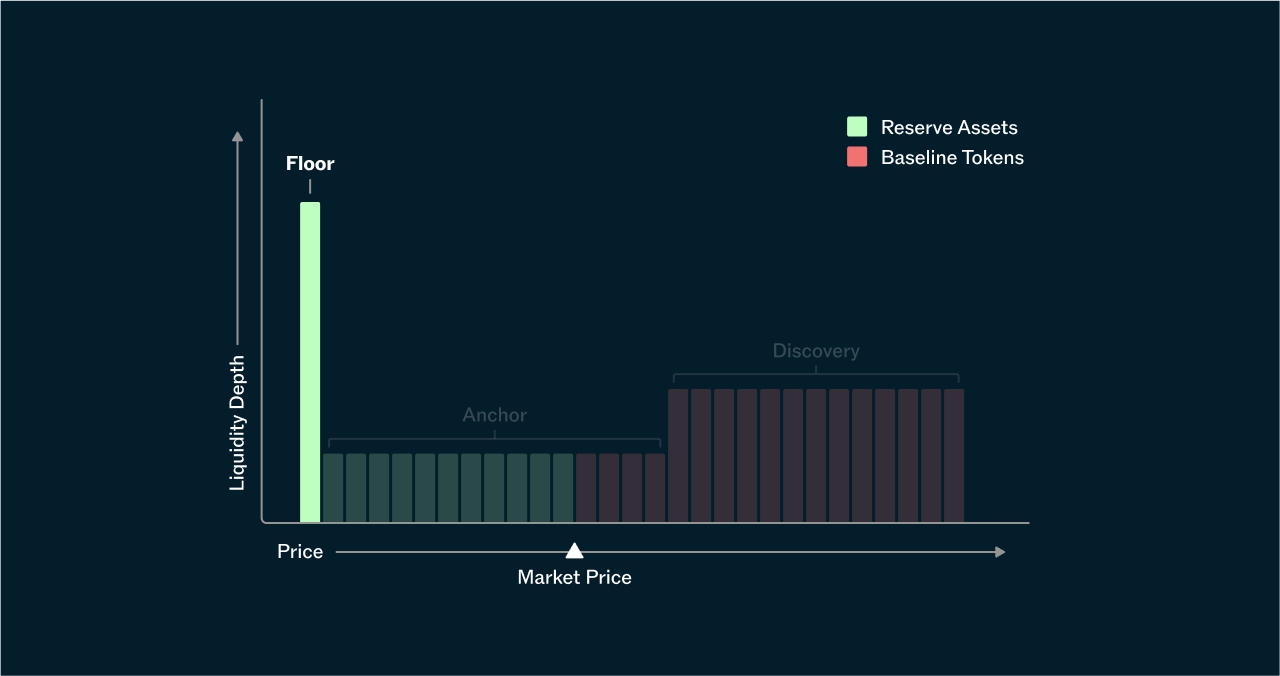

Baseline deploys liquidity across two key price ranges:

- Anchor Liquidity: A tightly concentrated range that ensures deep liquidity near the current price, stabilizing market movements.

- Discovery Liquidity: A broader liquidity range that allows price exploration and trend formation.

In previous versions, these two liquidity pools were highly interdependent. Now, they operate independently, allowing for more flexible and adaptive liquidity management.

Protocol-Owned Liquidity Positions

BLV is a buy wall for the last bToken holder to exit their position at the Baseline Value (BLV), located at the top of the Floor tick.

You may be wondering where the system sources the initial capital to guarantee the floor price. The liquidity is sourced from the presale of the Baseline Token (bToken). Unlike traditional token launches, where presale funds are typically distributed to the project team, Baseline token launches keep the liquidity in the market making system. See the IBLV section to learn how the initial liquidity is provisioned.

Adjusting Anchor Liquidity in Fast Markets

During rapid price declines, the system ensures that anchor liquidity remains efficient by automatically adjusting its position to prevent excess token minting. The updateTicks function calculates the spread between the discovery and anchor liquidity depth, and shifts the anchor’s tick placement dynamically, ensuring that liquidity is optimally deployed while avoiding unnecessary dilution.

Summary of Baseline V3

Baseline V3 introduces a new era of on-chain market making, emphasizing automation, capital efficiency, and sustainable liquidity management. The key innovations include:

- Rebalance as the Core Mechanism – A single function handles all liquidity adjustments, replacing fragmented liquidity operations.

- Leveraged Anchor LP – Uses borrowed reserves to increase liquidity depth without relying on external liquidity providers.

- Dynamic Liquidity Allocation – Anchor and Discovery liquidity positions are now independent, allowing for better price stability and market adaptation.

- Automated BLV Adjustments – BLV increases occur naturally when reserves support a higher price floor, ensuring sustainability.

Baseline V3 ensures that token markets remain liquid, efficient, and aligned with long-term growth, removing reliance on traditional market makers and external intervention.

If you’re interested in learning about how Baseline evolved over time, check out the historical documentation.