Leveraged bToken Exposure

While Baseline's lending facility allows users to leverage bTokens for exposure to other assets, 'looping' provides a unique way to gain amplified exposure to the bToken itself. Looping involves repeatedly borrowing against bToken collateral to purchase more bTokens, creating a leveraged position that increases sensitivity to the bToken's price movements relative to the underlying reserve asset.

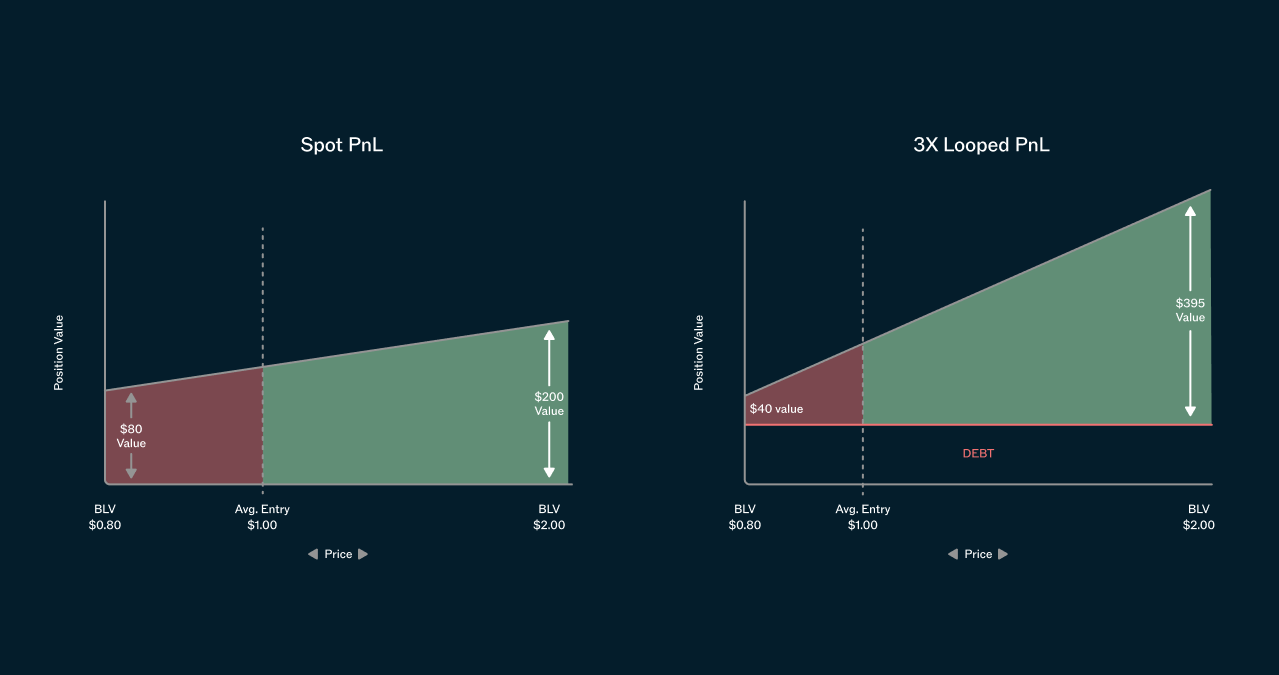

Like most forms of leverage, looping is an advanced strategy with significant risks. The strategy effectively trades the bToken's floor guarantees for additional premium exposure, exposing users to full 100% drawdowns when bTokens trade at the floor.

Users should thoroughly understand the mechanics and potential outcomes of looping before opening a position.

Looping Mechanics

Looping is not an infinite process. Each successive loop results in diminishing borrowing power due to the difference between the bToken's market price and its BLV.

To illustrate how looping works, let's walk through a simplified example. For clarity, we'll assume no additional costs such as slippage, or swap fees.

Initial Position

- User owns 1,000 bTokens

- Market price: 1.20 USDC per bToken

- Baseline Value (BLV): 1.00 USDC per bToken

-

First Loop

- User deposits 1,000 bTokens into the lending facility

- Borrows 1,000 USDC (based on BLV)

- Buys 833.33 bTokens at market price (1,000 USDC / 1.20 USDC per bToken)

-

Second Loop

- Deposits the newly acquired 833.33 bTokens

- Borrows another 833.33 USDC

- Buys 694.44 bTokens (833.33 USDC / 1.20 USDC per bToken)

Final Holdings

- Total Collateral: 1,833.33 bTokens (from both deposit steps)

- Wallet Holdings: 694.44 bTokens

- Total Debt: 1,833.33 USDC

In total, the user now controls 2,527.77 bTokens with 1,833.33 USDC in debt. Note that despite the increased bToken holdings, the net value of the position remains the same (assuming no fees or price changes):

- Initial Value: 1,000 bTokens @ 1.20 USDC = 1,200 USDC

- Looped Value: (2,527.77 bTokens @ 1.20 USDC) - 1,833.33 USDC debt = 1,200 USDC

However, if the bToken price rises to 1.40 USDC, the looped position will have amplified gains:

- Initial Value: 1,000 bTokens @ 1.40 USDC = 1,400 USDC

- Looped Value: (2,527.77 bTokens @ 1.40 USDC) - 1,833.33 USDC debt = 2,027.77 USDC (over 4x the upside!)

Similarly, if bToken's price falls to 1.00 USDC, the looped position will have amplified losses:

- Initial Value: 1,000 bTokens @ 1.00 USDC = 1,000 USDC

- Looped Value: (2,527.77 bTokens @ 1.00 USDC) - 1,833.33 USDC debt = 694.44 USDC

Origination Fee

Like Baseline loans, Baseline's looping facility charges an origination fee, and no interest rate. This fee is applied when opening a position or when adding to your loan based on the amount being added.

Benefits and Risks of Looping

Looping allows users to gain increased exposure to bToken price movements without additional capital investment. When the bToken's price rises relative to the reserve asset, looped positions can see amplified returns.

For example, if a bToken's price increases from $1.00 to $1.10 (a 10% gain), a looped position might see a 20% or greater increase in value, depending on the leverage used.