Baseline Market Maker (BMM)

The Baseline Market Maker (BMM) is an onchain algorithmic market maker that differs from traditional market makers in three fundamental ways:

- It operates 24/7 and autonomously with rules transparently enshrined in smart contracts.

- It splits the pool reserves into backing (floor protection) and buffer (price discovery).

- It quotes bid-ask prices based on token circulating supply.

By allocating liquidity intelligently, the BMM facilitates better price discovery and creates more efficient token markets for all participants.

Why BMM Matters

Most markets today use central limit order books to allocate liquidity. This approach requires every project to negotiate deals to bootstrap liquidity, and have professional market makers to actively manage quotes. In a world where most assets are issued digitally at an accelerating pace, this is no longer a viable solution.

Algorithmic Market Makers (AMMs) solve this by replacing active management with a bonding curve, a mathematical formula that quotes prices automatically using pooled liquidity. This approach, however, treats liquidity separate from the token, creating problems:

- Liquidity mismatch: Pools quote without knowing float, causing either low-float pumps (too much liquidity) or death spirals (too little liquidity)

- Value leakage: Most popular AMMs deploy liquidity even when they should protect reserves

- Death spirals: Without awareness of circulating supply, the AMM is unable to backstop negative market reflexivity, causing tokens to trend to zero.

BMM enables something traditional AMMs cannot: a guaranteed floor price that coexists with healthy price discovery.

How BMM Works

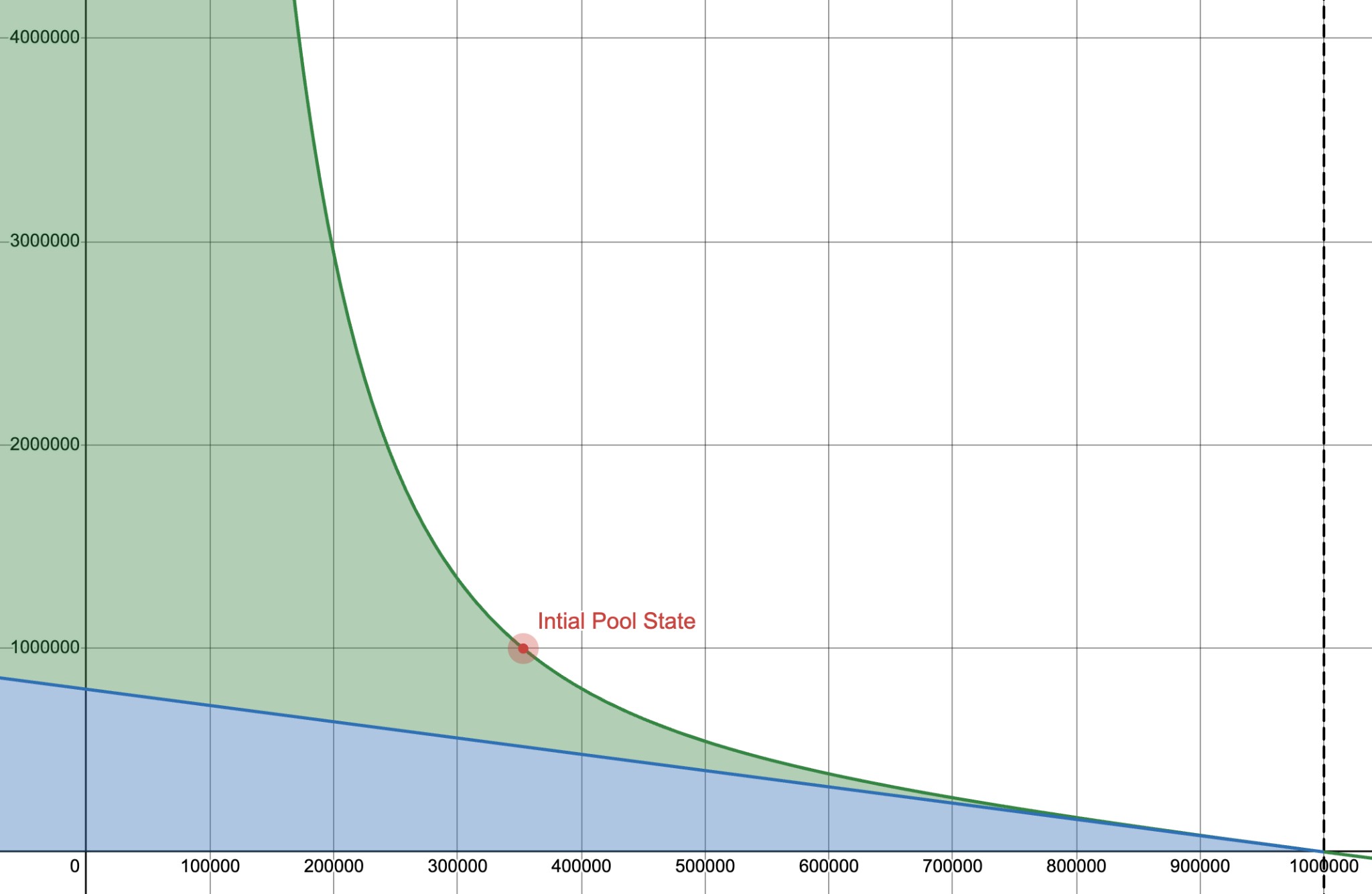

By using token-owned liquidity, BMM tracks circulating supply, pool inventory and pool reserves. BMM splits reserves into backing reserves (blue) and buffer reserves (green):

- Backing reserves guarantee every circulating token can be redeemed at the floor price

- Buffer reserves enable price discovery above the floor

The chart shows pool inventory on the x-axis and pool reserves on the y-axis. The blue area represents backing reserves required to buyback all circulating supply at the floor. The green area represents buffer reserves available for price discovery.

Backing reserves use the Baseline Value (BLV) to determine how much reserves to allocate for a given circulating supply:

Buffer reserves follow a power-law curve based on a ratio between circulating supply and pool inventory:

The invariant maintains a constant K by adjusting buffer reserves based on the inventory ratio (x/c):

- High circulation (x is small, c is large): Inventory ratio is low, so buffer reserves are large. The pool deploys deep liquidity to facilitate price discovery as tokens trade actively.

- Low circulation (x is large, c is small): Inventory ratio is high, so buffer reserves shrink. The pool withdraws liquidity as it absorbs supply, transitioning from price discovery to price protection at the floor.

In other words, the pool automatically scales buffer reserves based on how much supply is circulating, preventing the low-float, high-FDV distortions that plague traditional AMMs.

As trading happens, BMM captures value through the use of dynamic fees. This excess value is directed to increasing the BLV.

Benefits of BMM

- Token-Owned Liquidity: Instead of depending on unreliable counterparties, BMM operates programmatically, transparently and in perpetuity.

- Value Accrual: By managing its own liquidity, the token captures trading fees as revenue, and grows its own value over time.

- Efficient Markets: BMM creates efficient markets by allocating liquidity intelligently based on circulating supply and pool inventory.