The Baseline Afterburner

While most of the focus around tokenomics so far has been on Baseline's built-in protections against downside volatility, it's important to emphasize that bTokens have value beyond just their BLV: in fact, bTokens should expect to trade at a market value above the floor price.

This 'premium'—the ratio of market price to BLV—is how bTokens generate additional market value beyond the liquidity in the pool, creating a net wealth effect for bToken holders. As such, sustaining a healthy market premium is equally as important to bTokens as growing the BLV. To facilitate this, Baseline comes with another system: the Afterburner.

Capital Efficiency

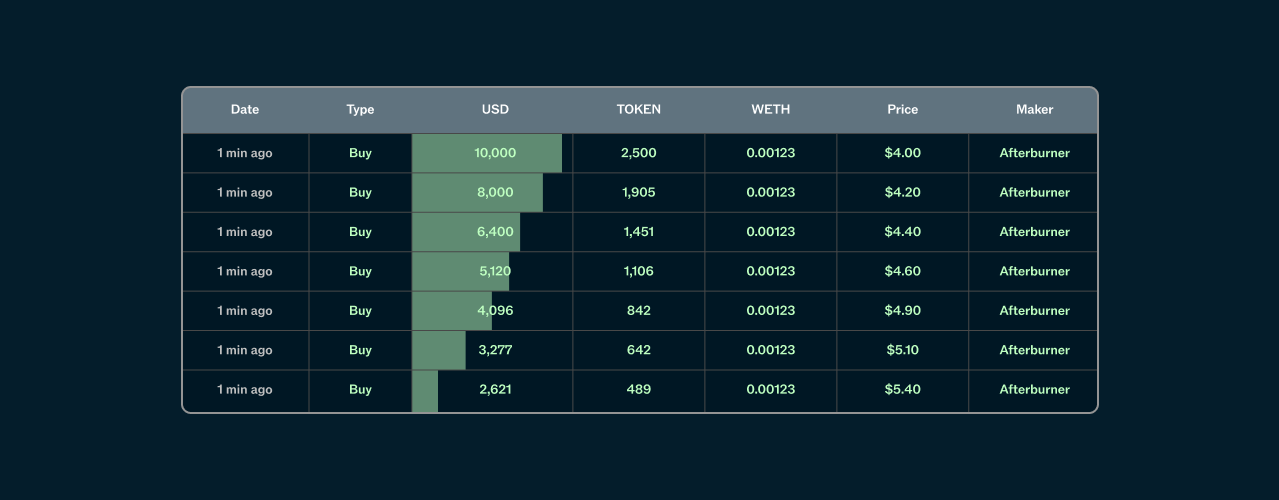

One key feature of Baseline is the ability to borrow a bToken's underlying BLV value by using it as collateral. The Afterburner also takes advantage of this feature, using any purchased bTokens to borrow more liquidity for an even more impactful buyback. To optimize for capital efficiency, the Afterburner fires a larger portion of funds at lower premiums, allowing the protocol to not only buy tokens at a cheaper price, but also take advantage of the cheap leverage offered by the system.

This is because the loan-to-value (LTV) ratio increases as a bToken trades closer to its floor price, naturally increasing the system's available leverage. For instance, at a 10% premium, Baseline offers 90% LTV on loans, enabling the Afterburner to execute buybacks with 10x leverage. In this case, a $20,000 leveraged buyback would transform into $200,000 market bids, allowing this strategy to maximize its impact on the bToken's market value.

Guaranteed Buy Pressure

The Afterburner conducts periodic leveraged bids directly on the open market, passively growing a bToken's market premium. The Baseline Afterburner is financially self-sufficient, using flows generated by Baseline's protocol operations (e.g. trading fees from protocol-owned liquidity and interest payments from bToken loans) to finance its buybacks.

The Afterburner runs at all times and under all market conditions, naturally generating market premiums even in the absence of external demand.

Buyback Execution Strategy

The Afterburner attempts to "fire" at regular intervals, typically every 10-15 minutes. Each attempt has a randomly determined probability of success to prevent frontrunning. The initial odds start at 1% (1/100) and progressively increase with failed attempts, capping at 3% (1/33). After a successful firing, the probability is lowered, allowing the system to "cool off."

The size of the buyback is always a portion of the total accumulated fees and scales based on the bToken's market premium. The afterburner uses funds as they come in, but this scaling ensures that some funds always remain in the system for future buybacks, allowing the Afterburner to run indefinitely.

This strategy is designed to release value from accrued fees over a longer period of time, skewing the value distribution towards holders with longer time preferences.