Token-Owned Liquidity (TOL)

Token-Owned Liquidity (TOL) means the token itself owns and manages its liquidity position. Instead of renting liquidity from external market makers or incentivizing mercenary liquidity providers, the token maintains its own market.

This is Baseline's answer to the capital formation problem: balance sheets should be native to the market.

Why TOL Matters

Historically, tokens externalized liquidity management in a variety of ways:

- Professional market makers: Projects partner with professional market makers to manage their liquidity pool. The terms of the deal are signed off-chain and are often expensive, requiring projects to give up a percent of their supply to the market maker, either at the time of the deal, or structured as call options.

- Initial Exchange Offerings (IEOs): Projects partner with centralized exchanges to list their token. This creates a dependency on the exchange for liquidity and trading. These deals are often slow and, even worse, require projects to give up a percent of their supply to the exchange.

- Rented liquidity: Projects incentivize transient liquidity with token emissions that get farmed and dumped. Pool2 farming, popular in DeFi summer, is a prime example.

- Automated Liquidity Management (ALM): Projects use automated liquidity management services to manage their liquidity pool. These services are a combination of rented liquidity and professional market making, suffering from the same issues.

In all cases, externalizing liquidity management makes liquidity an ongoing cost to the project, and ensures that any value built up through trading gets extracted by third parties.

Projects that have tried to internalize liquidity management quickly realized the challenge of working with AMMs. For example, poorly configured xy=k curves quote price per token that vastly undervalues the token in low float scenarios. Launching the pools yourself runs the risk of selling supply for cheap or getting supply sniped. In all cases, the project is forced to pay a premium in form of opportunity cost, that may be difficult to recover from.

Token-Owned Liquidity solves these issues by internalizing the responsibilities of liquidity management, and aligning the rules to token value.

| Aspect | Rented Liquidity | TOL (Baseline) |

|---|---|---|

| Ownership | Market makers | Token itself |

| Costs | Ongoing payments | None |

| Fee Capture | Lost to third parties | Revenue-generating asset |

| Floor Price | None | Guaranteed BLV |

| Sustainability | Mercenary | Structural |

Key Insight: Whereas traditional launchpads let you launch tokens, Baseline lets you launch tokens that grow in value over time. This is uniquely possible because the token owns its liquidity.

How TOL Works

Token-Owned Liquidity uses circulating supply, pool inventory and total supply to maintain an internal balance sheet, with assets and liabilities tracked onchain.

Supply Accounting

The token's total supply is split into pool inventory and circulating supply:

Where:

- = pool inventory (tokens owned by protocol)

- = circulating supply (tokens held by users)

- = total supply

Pool inventory is an asset (disposable, no liabilities) while circulating supply is a liability (must be redeemable at BLV).

Reserve Accounting

The reserves in the liquidity pool are split into backing reserves and buffer reserves:

Where:

- = backing reserves (guarantee redemption at floor)

- = buffer reserves (enable price discovery)

The protocol treats backing reserves as non-negotiable assets that must be allocated to buyback the entire circulating supply at the floor price.

The buffer reserves are the speculative portion, allocated intelligently to support price discovery above the floor.

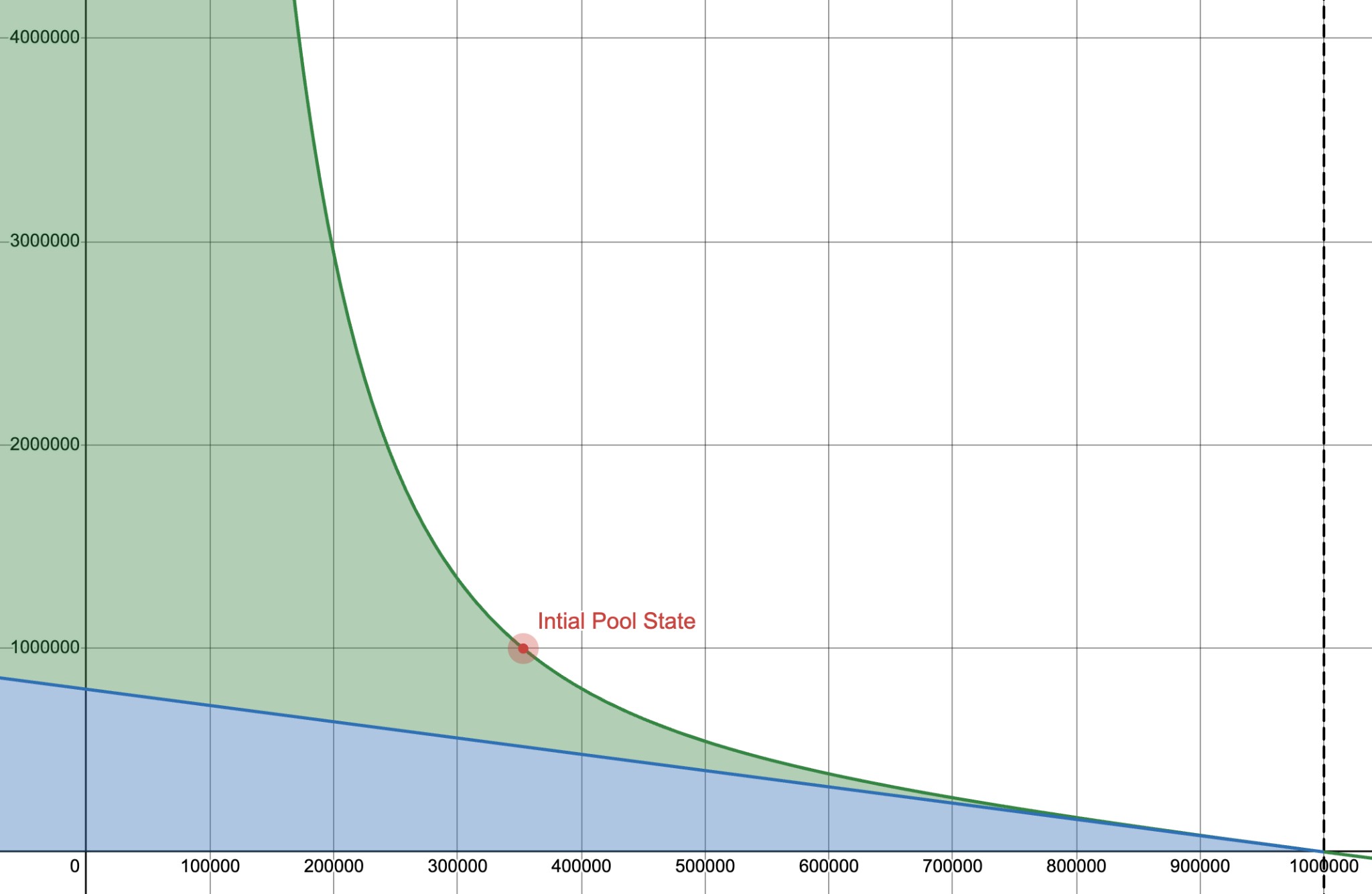

The x-axis represents pool inventory and y-axis represents total reserves. The blue area represents the backing reserves required to buyback circulating supply at the floor. The green area represents the buffer reserves available for price discovery. The sum of both areas equals total reserves.

Baseline Value (BLV)

The Baseline Value (BLV) is the guaranteed floor price, defined as backing reserves divided by circulating supply:

BLV is the minimum price at which any holder can exit, regardless of market conditions. Learn more about BLV.

Book Price

The book price is total reserves divided by circulating supply:

Book price represents the total value backing each circulating token, including both guaranteed floor and speculative buffer.

Benefits of TOL

- Transparency: All liquidity, reserves, and accounting are onchain and verifiable. No off-chain deals or hidden terms.

- Guarantees: Every token has a guaranteed floor price (BLV) that can only increase. Holders always have an exit.

- Programmability: Liquidity rules are encoded in smart contracts, enabling composability with other DeFi protocols like borrowing and leverage.

- Revenue-generating: Trading fees flow to the token's balance sheet, increasing BLV over time. Your token becomes a revenue-generating asset instead of paying market makers to provide liquidity.